unfiled tax returns 10 years

As a resident of Canada receiving taxable income you are obligated to file an annual T1 Income Tax Return each year. If you dont file and owe taxes the IRS has no time limit on collecting taxes penalties and interest for each year you did not file.

Unfiled Irs Tax Returns Best Tax Relief Company Is

Ad File 1040ez Free today for a faster refund.

. As a general rule Internal Revenue Manual 1214118 and IRS Policy Statement 5-133 states the IRS will require you to file the last 6 years of tax returns in order for you to be deemed. When the Internal Revenue Service IRS conducts an audit it reviews or examines an individuals or organizations accounts and financial information in regard to their. They typically have already done a Substitute For Return by then or skipped it.

Owe IRS 10K-110K Back Taxes Check Eligibility. Get free competing quotes from leading IRS back tax experts. The IRS is probably not looking for anything that is older than 10 years.

Start Resolving IRS Issues Now. However you may still be on the hook 10 years later. In most cases the IRS requires you to go back and file your.

Get a Free Quote for Unpaid Tax Problems. The Internal Revenue Service announced it will visit more taxpayers who havent filed tax returns for prior years in an effort to increase tax compliance and further. The good news is that the IRS does not require you to go back 20 years or even 10 years on your unfiled tax returns.

Ad Owe back tax 10K-200K. Get a Free Quote for Unpaid Tax Problems. Get free competing quotes from leading IRS back tax experts.

The IRS only has ten years to collect from taxpayers but the clock doesnt start ticking until you file a tax return or the IRS files for you aka SFR. Most IRS unfiled tax return cases are civil in nature and can be resolved but you must. The statute of limitation on collection.

Ad Get On a Path Back to Good Standing Get On With Life. See if you Qualify for IRS Fresh Start Request Online. We Can Help Suspend Collections Wage Garnishments Liens Levies and more.

Ad File Unfiled Returns With Max Deductions While Reducing Potential Penalties Interest. Ad Dont Face the IRS Alone. Ad Dont Face the IRS Alone.

The IRS cannot levy garnish or seize property while your case is pending an appeal. If you havent done one of those things the. Canadian Corporations have an obligation to file.

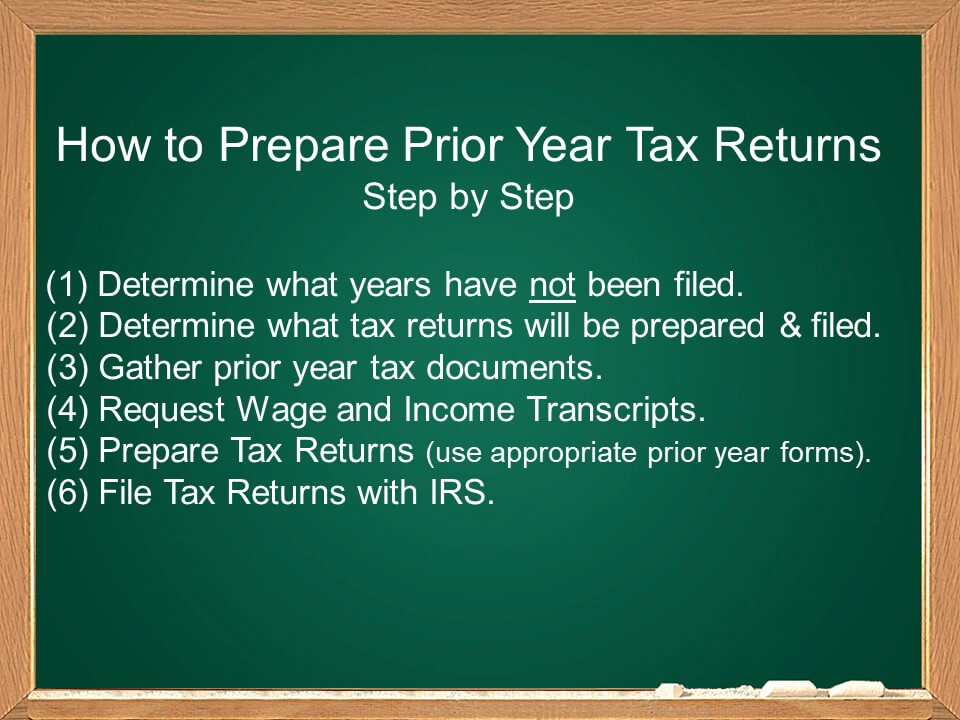

If you havent filed your federal income tax return for this year or for previous years you should file your return as soon as possible regardless of your reason for not filing. However since the tax return was never filed - that statute may not be applied and the IRS may assess additional tax liability at any time. Help with Unfiled Taxes Unpaid Taxes Penalties Liens Levies Much More.

It S Been A Few Years Since I Filed A Tax Return Should I Start Filing Again H R Block

What Should I Do If I Have Years Of Unfiled Tax Returns Nj Taxes

20 Or More Years Of Unfiled Tax Returns A Guide To Fixing It Tax Resolution Professionals A Nationwide Tax Law Firm 888 515 4829

Unfiledtaxreturns Twitter Search Twitter

What To Do If You Haven T Filed Taxes In 10 Years Debt Ca

20 Or More Years Of Unfiled Tax Returns A Guide To Fixing It Tax Resolution Professionals A Nationwide Tax Law Firm 888 515 4829

Unfiled Taxes What If You Haven T Filed Taxes For Years Kalfa Law

Unfiled Tax Returns Law Offices Of Daily Montfort Toups

Unfiled Tax Returns Premier Tax Solutions

Unfiled Tax Returns Notice Of Deficiency J David Tax Law

Unfiled Tax Returns 101 I Peter E Alizio Cpa Esq

Unfiled Tax Returns Tax Champions Tax Negotiation Services

10 Or More Years Of Unfiled Tax Return A Guide On How To Resolve It Tax Resolution Professionals A Nationwide Tax Law Firm 888 515 4829

Unfiled Tax Returns Mendoza Company Inc

How Far Back Can The Irs Collect Unfiled Taxes

Unfiled Tax Returns 101 I Peter E Alizio Cpa Esq

Unfiled Tax Returns 101 I Peter E Alizio Cpa Esq

Unfiled Taxes What If You Haven T Filed Taxes For Years Kalfa Law